Disclaimer: The information in this article is general in nature and based on publicly available data from Realestate.com.au. Suburb-specific statistics were sourced from: Caboolture, Logan Central, Deception Bay, Southport, and Maroochydore. Readers should seek independent advice before making investment decisions.

Finding the right property can be nerve-racking. The moment you make the decision, you may be locked into that investment for decades. Are you looking for a steady income or capital growth potential? How do you even identify a high-yielding property? Making an educated decision about a property’s potential return requires reliable information. This article provides a starting point for your research.

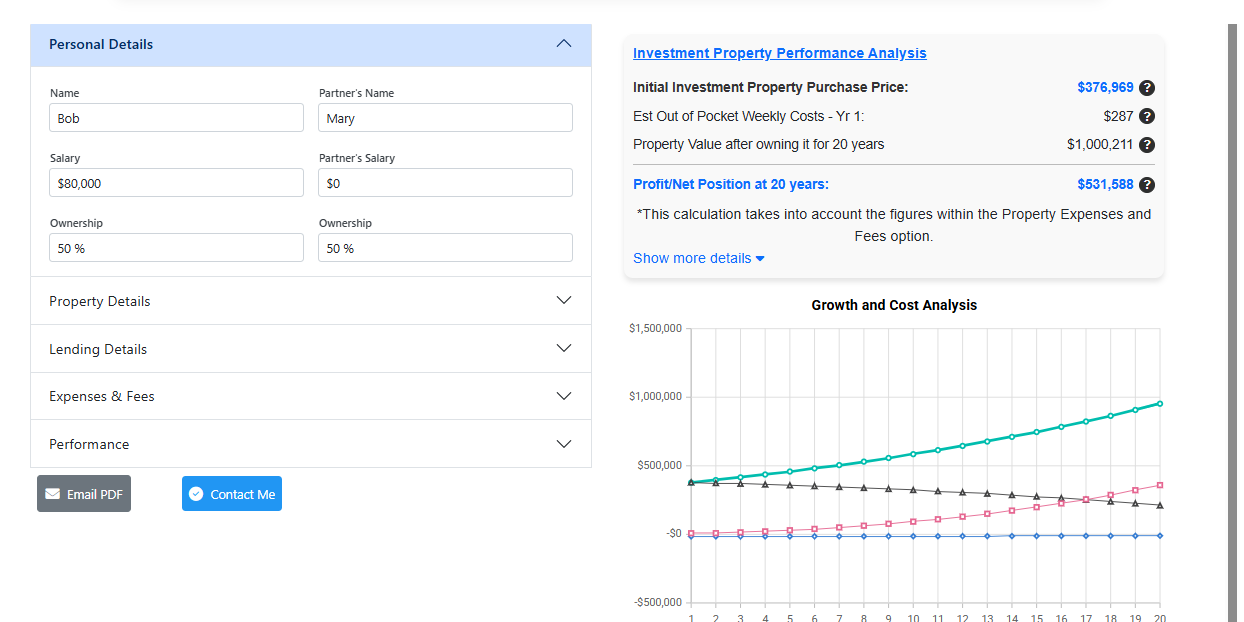

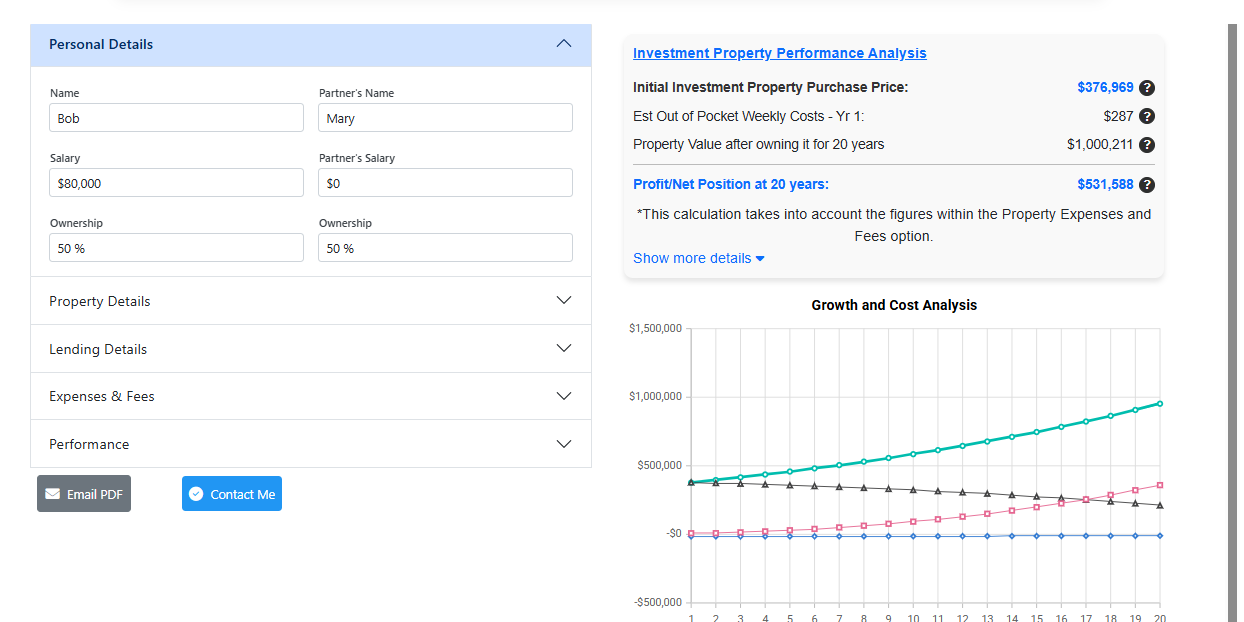

Use our property calculator to see your potential returns.

How to Identify High-Yielding Property Investments

This article provides an overview of South-East Queensland for your consideration. The property market in this small part of the world has experienced higher growth than areas such as:

- Northern Territory

- Western Australia

- South Australia

- New South Wales

Here are our picks for the five highest rental yield suburbs in South-East Queensland based on the latest data on market value.

Top five high rental yield suburbs at a glance

- Caboolture- Moreton Bay

- Logan Central- Logan

- Deception bay- Moreton Bay

- Southport- Gold Coast

- Maroochydore- Sunshine Coast

Rental yields

Before we get ahead of ourselves, what is a rental yield? The rental yield is a property's annualised rental income as a percentage of the purchase price. The formula looks like this:

Annual rental income ÷ purchase price x 100= annual rental yield.

There are two types of yield that you can calculate for a property: a gross yield and a net yield.

- Gross rental yield. The gross yield is a simpler calculation. It takes the annual rental income before accounting for any expenses.

- Net rental yield. The net yield is slightly more complicated. It takes the annual rental income after factoring in the expenses incurred to own the property. Expenses may include:

- Land tax

- Council rates

- Insurance

- Property management fees

- Repairs and maintenance

The net yield is often seen as the more accurate calculation. However, the net yield is more specific to the circumstances of each property.

What is a good rental yield?

Terms like 'good yields' or 'high yields' are subjective. Assessing what properties offer good returns depends on many criteria, such as location and the broader economic conditions of the suburb. A good yield for the Sunshine Coast may fall somewhere between 3% to 5%. Higher-yielding properties may offer 5% to 7% or more.

What you consider a good or high yield will depend on your investment goals. Seek advice from a qualified financial expert and a registered tax agent to accurately assess what rental yield suits your circumstances.

Here are some considerations that may influence a property's rental yield:

- Location. Location has been touted in real estate as the most important factor in a property's value for a long time. Proximity to schools, local employment prospects, and lifestyle appeal are just some of the myriad ways a location may affect a property's yield.

- Vacancy rates. A property's rental yield is affected significantly by how much time it spends occupied by tenants. Lower vacancy rates result in greater rental income.

- Purchase price. The rental yield is calculated as a percentage of the purchase price. You won't be surprised, then, that the property's price directly affects the yield. For example, a luxury property with a high purchase price will typically have a lower yield.

- Property condition. Well-maintained properties may attract higher rents. Renovations and amenities such as air conditioning and convenient parking may contribute to a higher yield. However, work done on a property will affect its net yield.

Use our property calculator to see your potential yields.

Rental yield versus capital growth

Two major considerations investors face when seeking opportunities in the property market are the rental yield and potential capital growth. How you weigh the importance of these factors depends on your personal objectives. Here are some criteria investors might think about.

Investment horizon

How long do you anticipate holding the property? Real estate is usually considered a long-term investment. But think about your stage of life. Are you a retiree? Maybe you're looking for higher yields for more immediate benefits. A young investor may have a different perspective. They might be okay with settling for lower yields in favour of long-term growth.

Tax considerations

A major part of the tax considerations in property investing concerns the concept of gearing, which is simply when you borrow money to purchase an asset. Gearing is particularly relevant to property investing since investors often require a loan to access the property market. A positively geared property produces positive cash flow as its rental income exceeds its expenses. A negatively geared property incurs a net loss.

Gearing has important tax implications. Positive gearing provides immediate cash flow for the property owner. However, increased annual income means increased tax. Negative gearing may allow the property owner to use deductions to reduce their tax burden. You must remain compliant with Australian tax regulations and be willing to accept the long-term financial risks.

Disclaimer: This is general information that doesn't account for your personal financial circumstances or objectives. Get advice from a professional financial adviser and a registered tax agent to determine the best strategy for your financial situation. FAA Property does not provide financial, tax, or legal advice. All information is general and does not take your personal circumstances into account. You should seek advice from appropriately qualified professionals.

Caboolture-Moreton Bay

Caboolture blends rural and urban lifestyles. It has schools, hospitals, and shopping centres. The suburb has a multicultural community and hosts many cultural events throughout the year. Its vibrant atmosphere contributes to high tenant demand.

Caboolture has seen growth in the local property market over the past 12 months. The median house price increased by more than 12% and the median unit price by more than 23%. Despite this, Caboolture's median house price of $770,000 as of October 2025 is still below the Queensland average of $977,300 as reported by the Australian Bureau of Statistics in their latest quarterly report ending June 2025.

Use our calculator to see potential returns in Caboolture.

|

Housing |

Units |

| Median price (YoY) |

$770,000 (+10%) |

$475,000 (+26.7%) |

| Current rental yield |

4.1% |

4.5% |

Vacancy rate: 0.8%

Deception Bay- Moreton Bay

Deception Bay offers stunning bay views and a laid-back lifestyle. It offers something for a wide range of potential tenants. Retirees may enjoy the serene coastal atmosphere. Young families can take advantage of the picturesque walking trails and modern amenities. We're sure that professionals would appreciate the easy access to Brisbane along the Bruce Highway.

|

Housing |

Units |

| Median price (YoY) |

$753,500 (+10%) |

$580,000 (+21.8%) |

| Current rental yield |

4.1% |

4.4% |

Vacancy rate: 0.47%

Use our calculator to see potential returns in Deception Bay.

Southport- Gold Coast

Southport is predicted to see some of the highest rental yields in the future. Why? The 2032 Summer Olympics might have something to do with it. Southport will host certain sporting events. It's little wonder that significant investment is being made into the local economy to support the upcoming Games. Southport is attracting more property investors, and demand for property is increasing. This may result in strong rental yields and good capital growth in the near future, giving it potential for property investment.

Use our calculator to see potential returns in Gold Coast.

|

Housing |

Units |

| Median price (YoY) |

$1,182,500 (+11.4%) |

$700,000 (+9.0%) |

| Current rental yield |

3.4% |

4.9% |

Vacancy rate: 1.31%

Maroochydore- Sunshine Coast

The Sunshine Coast boasts some of the highest population growth in regional Australia, making it a hotspot for property investors. Maroochydore, in particular, is rapidly emerging as the coast's central hub, with significant investments in local infrastructure driving its appeal.

The growth trends we see in Maroochydore are similar to other areas, such as:

- Central Queensland.

- Regional Victoria.

- Port Augusta.

Property investors are starting to sit up and pay attention to what regional areas have to offer. Regional population centres like the Sunshine Coast are becoming a popular destination for tourists and people looking for a change of scenery.

Use our calculator to see potential returns in Maroochydore.

|

Housing |

Units |

| Median price (YoY) |

$1,157,500 (+5.2%) |

$782,500 (+5.0%) |

| Current rental yield |

3.5% |

4.1% |

Vacancy rate: 1.13%

The FAA Property difference

At FAA Property, we work with our clients to help them understand their options and find opportunities that suit their investment goals. Here's what it means to experience the FAA Property difference:

- Broader market access. You might visit real estate websites and think that's all there is for sale. By working with us, you can expose yourself to off-market opportunities. These may offer below-market rates.

- Targeted research. We don't just pull numbers out of thin air. We provide data-driven analysis of potential high-growth areas. Whether you're looking for capital growth or good yields, we tailor our services to each client.

- Investment objectives. We want to get to know you and your investment goals. Our clients come from all walks of life. You might be looking for the highest gross rental yield available. Then again, rental income may not be your priority. Once we understand your needs, we'll get to work finding the perfect property for you.

Call us today to organise an obligation-free consultation.

Disclaimer: Our property services are delivered separately from any financial services provided under an Australian Financial Services Licence. Initial consultations will not contain any personal advice.

From our clients

Disclaimer: The following client feedback is personal opinion. It may not reflect the experiences of all clients. Past performance is not a reliable indicator of future returns.

FAA have managed my property for the last five years. Very professional staff and service. Great communication between office and client always happy to assist. Easy recommendation to anyone looking for a reliable team.

- Tipene Doobs

From day one Kayla and the team have been amazing, assisted us into our home especially after relocating interstate. Their professionalism and approach to us was and remains outstanding.

- Kim Dunn

Kayla and her team are always informative as to issues that concern our property. They follow up with maintenance or enquiries promptly and professionally. We appreciate you all for looking after our rental property. :)

- Sally Rudd

Conclusion

There's a lot happening in South-East Queensland. Opportunities abound in the lead-up to the 2032 Olympics. The region has experienced strong growth in the recent past. Does that mean yields are guaranteed to keep going up? Absolutely not. You need good information to make informed decisions. We hope this article can cast some light on the Queensland property market.

Property values have soared in the capital cities, but investors seeking the highest growth rental yields and sustainable cash flow may look to regional areas.

Use our calculator to see potential returns in these top suburbs. The calculator provides general estimates only and does not constitute financial, investment, or tax advice. Results may not reflect your personal circumstances. You should seek professional advice before making investment decisions.”

Use our property investment calculator to improve your potential returns.

Written by

Michael Hehir

Director & Financial Consultant

Michael has worked in the financial services industry for 2 decades and has vast experience across multiple areas including, Salary Packaging, Mortgage Broking, Investment Properties, Shares, Insurance and Superannuation.

Through Michael's extensive Consulting career at FAA, he has specialised in working with State and Local Government employees on their long-term retirement goals.

Michael has a young family on the Sunshine Coast and a passion for technology and sport for his kids.